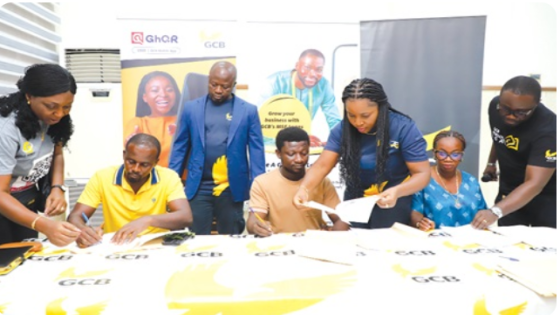

GCB Bank PLC has launched a GH¢3 million loan package to aid Micro and Small Enterprises (MSEs) affected by recent fires at Kantamanto and Techiman markets. This initiative, announced on February 3, 2025, aims to help over 200 traders rebuild their businesses. How can financial support transform lives in times of crisis?

- GCB Bank launches GH¢3 million loan package

- Support for traders affected by market fires

- Flexible repayment plan and insurance included

- Focus on financial literacy for traders

- Commitment to nurturing small enterprises

- Tailored solutions based on customer feedback

GCB Bank’s Initiative to Support Fire-Affected Traders in Ghana

How can a bank make a real difference in the community? GCB Bank’s new loan package is designed to provide immediate relief to traders whose livelihoods were disrupted by devastating fires. This support not only helps them recover but also empowers them to rebuild stronger businesses.

Understanding the Support Package for MSEs in Ghana

The loan package from GCB Bank is structured to meet the unique needs of affected traders. Here are some key features:

- Flexible repayment plans tailored for traders.

- A three-month moratorium before repayments begin.

- Insurance coverage through the GCB Value Added Package (VAP).

- Loan amounts up to GH¢50,000 based on account activity.

Financial Education: A Key Component of Recovery

GCB Bank recognizes that financial literacy is crucial for preventing future losses. By educating traders on effective financial management, they can safeguard their assets better. This initiative aims to:

- Encourage traders to keep their money in secure accounts.

- Provide business advisory support to enhance growth.

- Help traders understand the importance of financial planning.

Long-Term Vision for Micro and Small Enterprises

GCB Bank is not just focused on immediate relief; they have a long-term strategy to nurture MSEs into larger businesses. This involves guiding them through various growth stages, ensuring they are equipped to thrive in the competitive market. How can such support reshape the future of small businesses in Ghana?

In conclusion, GCB Bank’s GH¢3 million loan package is a vital step towards rebuilding the lives of traders affected by the fires. By combining financial support with education, GCB is paving the way for a more resilient business community.