On February 6, 2025, the new Belgian government proposed a significant change in pension policies. The plan suggests that working longer could lead to higher pensions, while retiring earlier may result in reduced benefits. How will this affect your retirement plans?

- Early retirement impacts pension amounts

- Working longer increases pension benefits

- New federal government policy introduced

- Pension bonus and malus explained

- Calculation tool available for impact assessment

How Will Belgium’s Pension Reforms Impact Your Retirement Plans?

The recent pension reforms in Belgium raise important questions about retirement strategies. Are you considering working longer to boost your pension? Or are you tempted by the idea of retiring early despite potential financial drawbacks? Understanding these options is vital for making informed decisions.

The Financial Implications of Working Longer or Retiring Early

The decision between working longer or retiring early can significantly impact your financial future. Here are some key points to consider:

- Longer work periods can increase monthly pension payouts.

- Early retirees face reduced benefits, affecting long-term finances.

- Pension bonus and malus systems will dictate how much you receive based on your choice.

- Your personal circumstances should guide whether to stay employed or retire sooner.

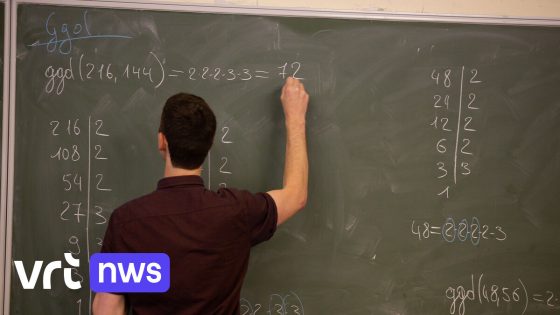

Understanding the Pension Bonus System

The proposed pension bonus rewards those who choose to work beyond the standard retirement age. This system aims to incentivize longer employment, ultimately leading to a more secure financial future for retirees. How does this affect you? If you’re nearing retirement age, it might be worth calculating potential benefits from extending your career.

The Consequences of Early Retirement

Choosing early retirement sounds appealing but comes with risks. Those who opt out early will see their pensions decrease significantly due to the malus system. It’s essential to weigh the immediate gratification against long-term security when considering this option. Have you thought about how an early exit could affect your lifestyle later on?

Calculating Your Future: Tools and Resources

To navigate these changes effectively, various online calculators can help assess how different scenarios impact your expected pension payout. By inputting factors like age, current savings, and desired retirement age, you can gain insights into what works best for you financially. Are you ready to take control of your retirement planning?